While analyzing a company, this ratio is compared to that of its peers, and/or its own historical records.Ī high working capital turnover is considered good as it indicates that the company is generating good sales compared to the funds invested in operations, i.e., the company is very efficient.įor some companies, there may be very low working capital, in which case this ratio will be useless. The working capital turnover ratio will be $1,200,000/$200,000 = 6.Ī working capital turnover ratio of 6 indicates that the company is generating $6 for every $1 of working capital.

A comparative benchmarking analysis of a company’s inventory turnover and DIO relative to its industry peers provides useful insights into how well inventory is being managed.

Operational working capital turnover free#

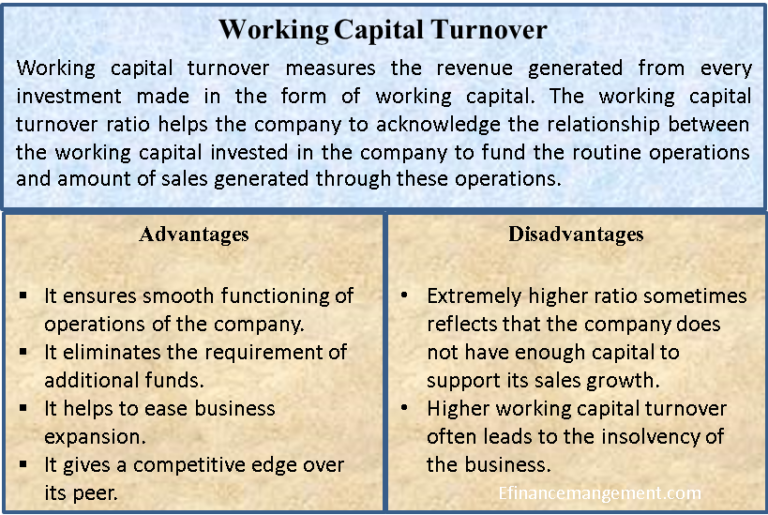

Its current assets were $700,000, and current liabilities were $500,000. An increase in an operating working capital asset, such as inventory, represents an outflow of cash, which is why in the free cash flow formula. W o r k i n g C a p i t a l T u r n o v e r = R e v e n u e A v e r a g e W o r k i n g C a p i t a l Working\ Capital\ Turnover = \frac W or kin g C a p i t a l T u r n o v er = A v er a g e W or kin g C a p i t a l R e v e n u e Īssume that a company has $1.2 million in sales for the year. Working capital turnover ratio measures how much revenue a company generates from every dollar of capital invested during a year.

Start of Cycle: The start of the cycle refers to the date when the inventory (i.e. Working capital turnover ratio reflects how effectively the company is using its working capital. Conceptually, the operating cycle measures the time it takes a company on average to purchase inventory, sell the finished inventory, and collect cash from customers that paid on credit.

0 kommentar(er)

0 kommentar(er)